My Active Capital: insurance + investment

It is a unique combination of life insurance and investment in investment funds, which provides the possibility of achieving higher incomes through investment in investment funds, and at the same time provides coverage in the case of death through a guaranteed sum assured.

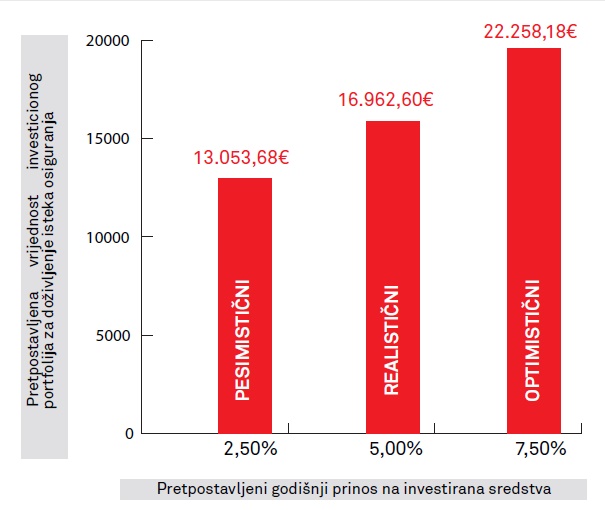

Example based on My Active Capital table data.

My Active Capital | |

|---|---|

Age | 40 years |

Contract duration | 20 years |

Method of payment | Annually |

Annual premium | 600€ |

Guaranteed sum insured in case of death | Set by client |

Key benefits

Full control

You independently choose the amount of the premium, the dynamics of payment, the amount of the guaranteed sum insured in case of death

Make a profit

Possibility of making larger profit than with classic life insurance

Investment

You get the opportunity to invest in the international financial market, investing in the world’s largest companies

Why do I need My Active Capital?

Being on the safe side or taking advantage of profit opportunities is always a question when managing money. With the product My active capital, you can arrange this ratio as you like – we call it an individual mix of a classic hedge fund (insurance) and an investment (income). You are also flexible when it comes to deposits, withdrawals and changes of funds.

Why not make an investment only?

The My active capital product allows you to profit from investing money and be life insured at the same time. No other product provides both benefits at the same time.

I can put money on savings account only?

If you have life insurance, then you are sure that your loved ones will receive the insured sum in case something happens to you. This is not the case with a bank savings account.

This product is for you if:

You are 14 – 65 years old

You understand that investment is the best way to make a profit

You want to have a life insurance through investment period

FAQ

My Active Capital is a type of Unit linked insurance. It is a unique combination of life insurance and investment in investment funds, which provides the possibility of achieving higher incomes through investment in investment funds, and at the same time provides coverage in the case of death through a guaranteed sum assured.

Depending on the level of risk, the client is allowed to choose one of the investment packages that differ both in the investment policy and in the investment funds included in them.

The objective of the investment funds included in the VIG Invest package is to profit from the performance of a predetermined market (shares, ETFs, government or corporate bonds, long-term or short-term deposits, treasury bills, etc.)

The invested money is distributed in two VIG funds, 50% in VIG Megatrend and 50% in VIG Alfa.

VIG Megatrend is structured as an action, so investors’ money is invested in global megatrends. Megatrends are long-term changes that have a lasting impact on our social and economic environment and represent long-term global processes that run through economic cycles and affect the whole world (demographic changes, improvement of efficiency due to scarce resources, urbanization, technological development and innovation).

VIG Alfa is designed as an “economic compass” that combines investing money in shares, corporate or government bonds of the developed part of Europe, as well as deposits with leading banks. This type of investment is characteristic of funds that have a multi-strategy investment dominated by “Global macro”, “Long-short equity”, “Convertible bond arbitrage” and “Managed futures” types of business.

The premium is paid multiple times, according to the dynamics chosen by the client – monthly, quarterly, semi-annually or annually, with a surcharge for sub-annual payments.

The minimum amount you can pay annually is €300.

An additional benefit for our clients is the possibility of contracting an additional one-time premium. By paying an additional one-time premium, the Policyholder can increase the value of his insurance policy. This type of payment can be made by the Contractor at any time during the duration of the insurance contract.

The Erste Green Balance package represents the perfect combination of “impact investment” and insurance. By buying shares of leading companies in the field of information technology, industry, renewable energy sources and sustainable development, all in accordance with the Paris climate agreement from 2015, you influence the future of the planet and at the same time create a safe investment.

In order to achieve a perfect balance and thereby provide you with more secure income, we also invest part of the money in government bonds of the most developed countries in Europe.

Your invested money is distributed in two investment funds in the ratio of 50% Erste Green Equity and 50% Erste Adriatic Bond.

The premium is paid multiple times, according to the dynamics chosen by the client – monthly, quarterly, semi-annually or annually, with a surcharge for sub-annual payments.

The minimum amount you can pay annually is €300.

An additional benefit for our clients is the possibility of contracting an additional one-time premium. By paying an additional one-time premium, the Policyholder can increase the value of his insurance policy. This type of payment can be made by the Contractor at any time during the duration of the insurance contract.

The minimum duration of the contract is 10 years, and the maximum is 25 years.

In the death case of the insured occurs during the term of the contract, we are obliged to pay a larger amount, when compared:

• the guaranteed sum assured in case of death which is specified in the insurance policy.

• 105% of the value of the investment portfolio minus the costs and taxes borne by the insurer when withdrawing funds from investment funds.

• Independently chooses the amount of the premium, payment dynamics, the amount of the guaranteed insured sum in case of death and which part of the premium is invested in investment units;

• It has the possibility of generating a higher income than with classic life insurance;

• Gets the opportunity to invest in the international financial market, investing in the world’s largest companies.

• The client bears the investment risk, that is, the consequences of fluctuations in the financial market;

• The client is not able to transfer money within the package from one fund to another.

Find out more

WVP PREMIUM

WVP PREMIUM open-end investment fund is an asset growth fund that invests at least 75% of its assets in equity securities.

The investment objective of the WVP PREMIUM fund is to predominantly invest in the shares of domestic and foreign issuers without geographic restrictions, up to a maximum of 100%. In certain moments when there is instability on the market and when a downward trend in prices is expected, the Management Company can reduce its exposure in shares, i.e. place part of the portfolio in debt securities, cash accounts or in deposits up to a maximum of 75% of assets, in order to negative effects were amortized.

The investment goal will be achieved by professional management of the Fund’s assets, that is, by creating a portfolio of securities that are listed on the most developed and regulated markets in the world. The focus of the Fund’s investment policy will be large companies – “Large Caps” that are leaders in their own industries and have a continuous and growing history of paying dividends to investors. In the investment process, special attention will be paid to minimizing the risk that may occur with this type of investment.

The investment principles of the WVP PREMIUM fund are: the principle of safety, the principle of portfolio diversification, the principle of maintaining liquidity and other principles in the function of risk dispersion.

WVP PREMIUM invests most of its assets in shares and is intended for investors who want to invest for the long term in a diversified portfolio of equity securities, with the aim of achieving a high rate of income, while accepting a higher level of risk.

ERSTE GREEN EQUITY is an equity fund that invests almost 85% of its assets worldwide primarily in companies from the field of environmental technology. The fund’s investment process is based on a detailed analysis of companies. Positive impact on the environment or society is of crucial importance in making investment decisions. The selection of shares takes place with an emphasis on companies in which a benefit for the environment could be determined and which are primarily active in the areas of water treatment and supply, recycling and waste management, renewable energy sources, energy efficiency, mobility, transformation and adaptation. The fund implements risk diversification by actively allocating assets and investing up to 15% of its net assets in liquid assets: money in the account, money market instruments and deposits.| Prospectus

According to its type of investment, ERSTE ADRIATIC BOND is a bond fund and is intended for more conservative investors who want to place their funds for a medium or longer investment period. The goal of investing is to achieve an appropriate return by investing funds for the recommended period, with a moderate level of risk. Adriatic Bond mainly invests in debt securities and money market instruments in Croatia, Slovenia, Bosnia and Herzegovina, Serbia, Montenegro, Macedonia, Albania, Romania, Hungary and Bulgaria. | Prospectus

Advantages for investors:

• High liquidity – quick disbursement of funds

• The possibility of a higher income than the income of the money fund in the recommended investment period

• Wide diversification of the fund’s portfolio reduces market risk (fall in share value)

• Exposure in accordance with the bond fund’s investment strategy

• The possibility of investing larger amounts at once or smaller amounts regularly

• High transparency of the Fund

For more information about other current packages, contact our agent or the sales department at +382 20 435 533.

Of course!

In order to make your protection more complete, it is possible to contract one or more supplementary insurances with the My Active Capital program:

Click HERE to read terms and conditions.